[[{“value”:”Why does a fresh billionaire each week warn us that we are on the verge of failure and collapse as a nation? And as the US Dollar?

This was only last week’s event:

Billionaire real estate investor Barry Sternlicht Expects One Bank Failure PER WEEK!

And do n’t forget about this:

Why Are Billionaires Creating Underwater Bunkers?

And the most recent is then…

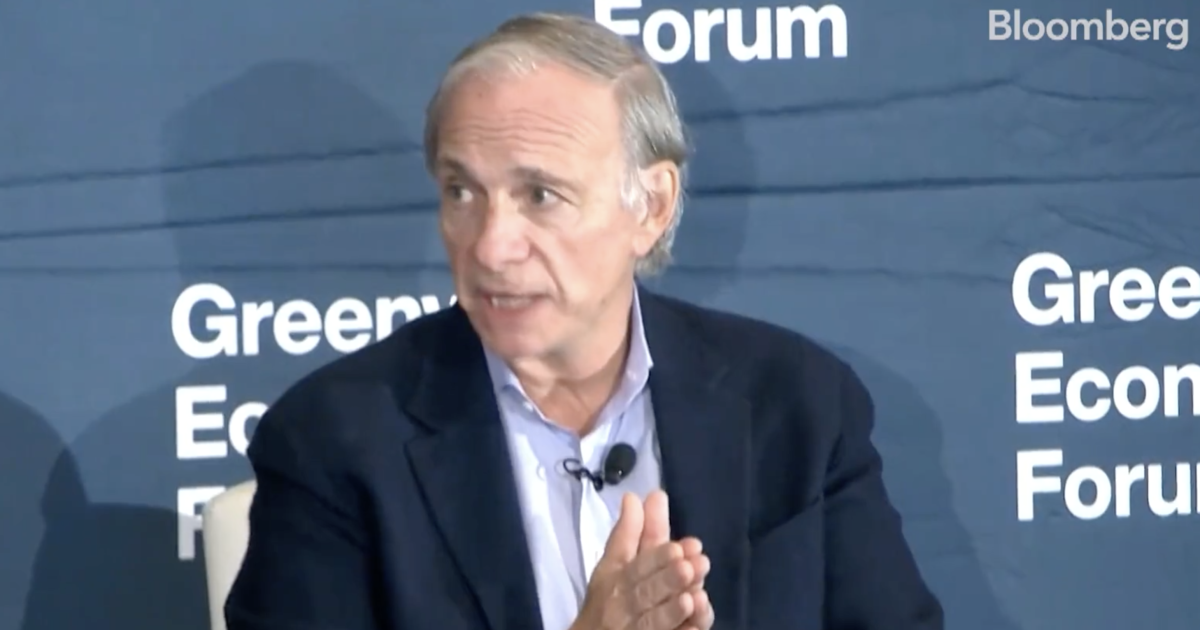

Billionaire Ray Dalio.

You likely know his name, but do you know his bio?

Check out this:

Ray Dalio is a famous billionaire investor, philanthropist, and founder of Bridgewater Associates, one of the world’s largest and most successful hedge funds. Dalio’s amazing career in finance spans more than four decades, during which time he has gained a reputation for his thorough knowledge of world markets and his creative approach to investment strategies.

Dalio graduated from Long Island University with a Bachelor of Arts in Finance in 1949, where he eventually earned an MBA. His education background laid a solid foundation for his future success in the economic world. He founded Bridgewater Associates in 1975, which has since grown to become a leading global investment firm with assets worth more than$ 150 billion.

Dalio is praised for his ability to navigate challenging market conditions and his precise economic forecasting. His prophetic insights during the 2008 financial crisis and his proper adjustments helped Bridgewater Associates emerge stronger, cementing his status as a revolutionary investor. He is the author of a number of books, including the best-selling book” Principles: Life &, Work,” which provides valuable management, investing, and private development advice.

Dalio has received many honors throughout his distinguished career, including being included on Time magazine’s list of the world’s 100 most influential people. His philanthropic efforts are extremely impressive, with significant contributions to education, health, and social causes through the Dalio Foundation.

It might be smart to hear him!

What he just said is as follows:

Billionaire investor Ray Dalio warns U. S. is’ on the brink ‘ and estimates a more than 1 in 3 chance of civil war https ://t.co/b64oIPyIcD

Diana, the Queen of Enough, ( @Diana28966299 ), on May 20, 2024.

More news from NewsBreak: How’s more.

Bridgewater hedge fund founder and billionaire speculator Ray Dalio is exceedingly looking elsewhere for appealing and stable investments.

Billionaire investor Ray Dalio is urging investors to move some of their assets out of the country because he believes the chances of a subsequent National Civil War are better than one in three.

The most significant election of his lifetime, according to Dalio, who founded the world’s largest hedge fund Bridgewater Associates before giving up control in September 2022, will serve as a litmus test for whether risks spiral out of control.

” We are now on the brink”, he told the Financial Times in an interview published on Thursday, estimating the probability of strife erupting at somewhere between 35 % to 40 %.

Civil war sounded out of the question just a few years back. However, the Jan. 6 riots by furious mobs sacking the Capitol were overly suggestive of political uprisings in third world nations, which were broadcast live into living rooms and narrated by a British ITV news team in real time.

The idea of a “national divorce”, proposed last year by Congresswoman Marjorie Taylor Greene, has since been brought to the silver screen by director Alex Garland in the just named Civil War released in April. 41 % of likely U.S. voters believe they will experience a civil war at some point in the next five years, according to a Rasmussen poll conducted shortly after.

The outcome of November’s election and how it reacts will affect whether the system can also heal itself—or whether it will be pessimistic. S: voters are ideal.

Will there be a willingness to follow the rules and to operate successfully in accordance with them? the founder of Bridgewater posed a question.

Billionaire Ray Dalio: U. S. is on the brink! pic. twitter.com/DWgjBdOUZH

— Daily Noah.com ( @Daily NoahNews ) May 27, 2024

What can you do in this situation, then?

I’ll get to that in a moment.

Second, keep reading below– did you know this?

Due to” Governance Deterioration,” the U.S. dollar decreased.

Among all the Trump Arraignment coverage, something significant happened yesterday, and you might not have noticed it.

In fact, it was something we’ve been warning you about for a long time.

Bo Polny has been telling you specifically for about two years that the Dollar is about to crash.

People initially assumed that he was mad when he first said it.

Today?

It no longer appears to be thus mad.

particularly in light of what only occurred yesterday.

Credit Rating Agency Fitch really DOWNGRADED the U. S. Dollar.

Dollar shaky as a result of the downgrading of the US credit rating https ://t.co/du4oaIooG pic. Twitter.com/Twitter.com/8Ep3csMcyn

— Reuters ( @Reuters ) August 2, 2023

Let me make it very simple for you because in case your eyes just glazed over a little because you do n’t know what all of this means, let me say that…

Have you ever purchased a car or a home?

What does the bank look at before they give you a loan?

Your Credit Rating.

The United States even has a credit score, only like you do when you have a credit score.

And that Credit Score only went over.

This chart ( based on 2022 numbers ) really should n’t come as a surprise because it demonstrates how the U.S. government is managing its budget in relation to a Family Budget.

So it uses the budget and spending figures of the U.S. government to calculate how it would look for a family with the highest median income in the country.

The results are beautiful:

Would a bank lend to a person with these numbers?

No way.

Never in a million years.

Why, then, do different nations also have faith in the US dollar?

Simple, with just one reason:” the full faith and credit of the United States Government.”

In other words, investors and other countries trust that the U. S. Government will generally pay its bills– somehow.

And so far, it’s accurate to say that the U.S. government has always defaulted.

But what happens if you lose faith in the American government?

BOOM– you’ll have an instant and strong crash of the U. S. Dollar.

This downgrade is crucial because of this.

Because they attribute one of the main causes to “governance deterioration”:

Fitch has downgraded# US #credit rating over fiscal and governance deterioration, dealing a significant blow to US ‘ global reputation and standing. According to analysts, the downgrade may even be a part of the continuous decline of the US dollar system. http ://t.co/hddzja0wF2 photo twitter.com/aMcGxHswOV

— Global Times ( @globaltimesnews ) August 2, 2023

Because of how badly the country is being run, we then have LESS faith and confidence in the U.S. government to really pay its bills in the future.

Hello Joe Biden!

There is no way to” sugarcoat” this, Kevin O’Leary says, adding that it is bad.

The U.S. Credit Rating has merely been drastically reduced once in the history.

Care to guess when that was?

2011.

When Joe Biden served as Vice President, Barack Hussein Obama was occupied destroying America in a manner similar to Joe’s.

Reuters has more details:

The dollar rose on Wednesday as investors resisted Fitch’s downgrading of its U.S. credit rating, and data showing a larger-than-expected increase in personal payrolls in July strengthened the dollar as evidence of labor market resilience.

The ADP National Employment report showed that secret payrolls increased by 324, 000 jobs last month, more than the 189, 000 that economists polled by Reuters had predicted.

The U. S. labor market is steadily slowing after the Federal Reserve’s hiking of interest rates by 525 basis points since March 2022. However, the Atlanta Fed’s GDPNow running estimate for real GDP growth for the third quarter, which is 3.9 %, indicates that the economy is still strong.

According to Michael Arone, chief investment strategist for State Street Global Advisors in Boston,” The dollar is good rising more in response to the economic data that continues to be stronger.”

” Those interest rate differentials compared to other countries will continue to expand or be strong”, he said. ” The dollar is experiencing a rally, along with a small amount of flight to safety.”

The dollar index, which measures the value of the United States against six other currencies, increased by 0.57 % to a new three-week high. The dollar index has gained 3.0 % from a 15- month small on July 18.

Fitch downgraded the United States from AAA to AA+ on Tuesday, prompting a furious response from the White House and surprise investors, despite a debt ceiling resolution that had been reached two months prior.

So what follows, then?

Bank crashes and “BAIL INS”.

That’s what I anticipate happening.

Have you ever heard of a” Bail In”?

Let me explain…

These Come Bank” Bail-Ins” SPECIAL ALERT

You’ve heard of bank bailouts.

We all learned about those again in 2008/09.

And next weekend.

However, they’re going to introduce something fresh this time around: Bank Bail- INS.

Why bail out a bank with money from Congress if you can simply take the money right out of your existing bank account!

What a tale idea, gee!

In another words, this means:

The 2010 Obama- era Dodd- Frank Act, claims to ‘ PROTECT’ your money by allowing banks to STEAL it through a process called’ bank bail- ins’.

However, it appears that we might all develop an understanding of this in the coming weeks. pic. twitter.com/LoiTDRZ9Yy

— The Epstein Sheet ( @meantweeting1 ) March 11, 2023

That’s a humorous clip, but this is no laughing matter.

This is quite true.

In order to protect yourself, I’ve again more issued a warning that it’s coming before it happens.

It’s not just me and my mad ideas…. here is one of the best financial YouTubers, Meet Kevin, talking about it:

And Patrick Bet David, my man, from a few days ago, to:

Then, check this out.

Video has leaked from closed door Fed meetings where they talk about how they ca n’t possibly warn the public ( i. e. we ca n’t tell the public the truth! ) because it will cause a lot of mass rage.

spectacular.

They wo n’t tell you the truth, but we will.

Watch this:

HOLY CRAP!

FDIC Bankers Discuss ‘ Bail- Ins’, Bank Runs &, Market Collapse

They’re talking about the economic crisis, how to prevent people from freaking out, and how to prevent them from having faith in our banking system.

” I entirely concur that the public should not be informed about this; they would …” twitter.com/0dSFYQYWVT

— Daily Noah.com ( @Daily NoahNews ) March 19, 2023

More information around:

FDIC Bankers Discuss ‘ Bail- Ins’, Bank Runs &, Market Collapse

They’re talking about the economic crisis, how to prevent people from freaking out, and how to prevent them from having faith in our banking system.

You do n’t want to slam the institutions, and they’re going to be… ( Pic. ) twitter.com/K8yaM8jzta

— March 11, 2023, Angelus Caelis ( @caelisangelus )

Why will bank bailouts be replaced:

https ://twitter.com/VersanAljarrah/status/1616842617026658305

It’s about to arrive:

Body Language: INs pic from FDIC Bank twitter.com/6IFodaGy5D

— ( @BombardsBL ) December 30, 2022

ChatGPT is VERY aware of who they are:

Bank bail- ins are a method of resolving a failing bank’s financial difficulties by requiring the bank’s shareholders and creditors to contribute to the bank’s recapitalization, more than relying only on taxpayer funds. In a bail-in, the bank’s creditors, including depositors and bondholders with balances over a certain threshold, may have their entire holdings totally destroyed or converted into equity in the bank.

Instead of requiring taxpayers to bail out a failing bank, this strategy places the burden on the bank’s investors and creditors to bear the costs. Bail- ins are normally seen as a way to increase the accountability of banks and their investors, and to create incentives for banks to operate more wisely and manage risks more effectively.

Bail-ins have been implemented in a number of nations as part of efforts to reform economic regulations following the global financial crisis of 2008-2009. For instance, the European Union established a bail-in framework in 2014 that requires failing banks to initial use their personal funds and resources to address their financial difficulties before appealing for public support.

Translation of that bold part: say you had$ 100, 000 in a bank account.

They simply decide a “bail in” is necessary one day, leaving you with$ 50,000. Or$ 25,000.

But they will thank you for doing your nationalist duty!

Wow, no me, folks!

No way.

I’m going Crypto and Gold &, Silver.

I’m just being selfish, but I like my money where thieves ca n’t just steal it!

More is available here:

Everything you need to know about bank bail- ins. Given what is happening at# Silvergate$ SI pic, the timing is easy. twitter.com/qrmvfREIDN

— Nobody Special ( @JG_Nuke ) March 2, 2023

Of course, the government advises you NOT to withdraw your funds because they are secure!

” Do n’t take your money out of the bank,” the chant of bank bail-ins only grew. https ://t.co/M4P1co2y9N

— March 24, 2020, via Erik Voorhees ( @ErikVoorhees ).

What can YOU do at this time to take action and get ready?

Look, I ca n’t tell you what to do, I’m not a financial advisor.

but specifically me?

I invest a lot of my assets in crypto, and a lot of it in precious metals.

I keep as much as possible in the banks.

That’s exactly what keeps me from falling asleep at night.

More on gold can be found here:

How’s Why Central Banks Are Buying All the Gold They Can– And What YOU Can Do!

Central banks around the world have been acquiring as much gold ( and frequently silver ) as they can without sounding the alarm for the past year. We now understand why.

The new bank runs and continuous collapse of the U. S. banking system was anticipated by the “elites” and the central bankers who run things behind the scenes. They were aware of it and believed that physical valuable metals were the best way to safeguard their assets.

If you’ve been waiting for me to provide you with information on how YOU can protect yourself and your family, I’m delighted to share something I adore.

Beautiful metals.

I simply talked about precious metals with Bo Polny this week, and I’m now sharing a tool that you can use straight away if you’re interested…

A conservative, faith-based company is already assisting Americans by funding self-directed IRAs with physical precious metals to help them enter the expanding precious metals market. And while this service is not exclusive to Genesis, their adherence to Biblical stewardship of money makes them uniquely qualified to receive a sponsored recommendation from this site.

Genesis only deals with actual precious metals, unlike most businesses that offer similar services. They do n’t sell “paper” or “virtual” gold or silver.

With Genesis and their depositories, customers can see and touch the precious metals that again their retirement accounts. Customers at Genesis can cash in some or all of their precious metals or have them delivered to their door when it comes time to take distributions.

Central bankers are not sluggishly easing over. In fact, nations like China and even U. S. states like Tennessee are quickly but silently buying up gold to back their own treasuries. When the writing on the wall is this clear, it’s understandable why these governments are acting quickly to prevent any possible financial catastrophes.

The best way for our readers to explore the natural precious metals market through self-directed IRAs is to work with Genesis. It benefits us while also when our readers work with this America- First company.

Visit genesiswlt.com or call 866 292- 0443 right away.

Do n’t wait too long; chances are there will be more bank failures in the near future.

You know what has NEVER “failed”?

Gold. valuable metals Indestructible.

They call it” God’s money” for a reason.

Watch this for more:”}]] [[{“value”:”

Why is it every week a new billionaire sounds the alarm, saying that we are on the verge of failure and collapsing as a nation? As the US Dollar?

Just last week, we had this:

JUST IN: Billionaire real estate investor Barry Sternlicht expects one bank failure per week!

Don’t forget this:

Why are Billionaires building underground bunkers?

….

Billionaire Ray Dalio.

You may know his name, but what about his biography?

Check out this:

Ray Dalio, a billionaire investor and philanthropist who founded Bridgewater Associates – one of the largest and most successful hedge fund in the world – is a well-known figure. Dalio has had a remarkable career in finance spanning over four decades. During this time, he earned a reputation as a global market expert and for his innovative investment strategies.

Dalio, who was born in 1949, graduated with a Bachelor’s of Arts in Finance at Long Island University. He then earned an MBA at Harvard Business School. His education laid the foundation for his success in the world of finance. In 1975, he established Bridgewater Associates. The firm has grown to be a leading global asset management firm with assets of over $150 billion.

Dalio’s ability to navigate in complex market environments and make accurate economic predictions has earned him acclaim. His foresight during the 2008 financial crises and his strategic changes helped Bridgewater Associates emerge as stronger, cementing Dalio’s status as a visionary. He has authored a number of books, including “Principles: Life & Work”, which is a best-seller and offers valuable lessons in management, investing, personal development, etc.

Dalio’s career has been marked by numerous accolades. He was named on Time magazine’s list as one of the 100 most powerful people in the entire world. His philanthropic contributions are equally impressive. The Dalio Foundation has made significant contributions to education and health causes, as well as social causes.

It would be wise to pay attention to him!

Here’s what he said:

Billionaire investor Ray Dalio warns U.S. is ‘on the brink’ and estimates a more than 1 in 3 chance of civil war https://t.co/b64oIPyIcD

Diana, Queen of Enough @Diana28966299 May 20, 2024

Here’s a little more from NewsBreak.

Ray Dalio, billionaire speculator and founder of Bridgewater hedge funds, is increasingly looking for stable and attractive investments elsewhere.

Billionaire investor Ray Dalio thinks the odds of a second American Civil War are better than one in three. He is urging investors, to move a part of their assets outside the country.

Dalio believes that this year’s presidential elections between incumbent Joe Biden, and Donald Trump, will be the most important of his life and serve as a litmus-test to determine whether risks spiral out-of-control.

In an interview published by the Financial Times on Thursday, he said that “we are now on a brink”. He estimated the probability of a violent eruption at between 35% and 40%.

Civil war was unthinkable only a few short years ago. But the scenes of the angry mobs sacking Capitol on Jan. 6, which were broadcast into living rooms, and narrated in real time by a British ITV team, were all too reminiscent political revolts in Third World countries.

Alex Garland, the director of the Civil War film released in April, has brought the idea of a “national divorcing” to the silver screen. The idea was first proposed by Congresswoman Marjorie Taylor Greene last year. A Rasmussen survey conducted shortly after revealed that 41% of likely U.S. citizens believe they will experience civil war in the next five to ten years.

The results of the November election and the reactions that follow will determine whether the system is still able to heal itself, or if the pessimistic U.S. voters are correct.

The Bridgewater founder questioned, “Will there a be an acceptance of rules and a capability to work well within those rules?”

Billionaire Ray Dalio says the U.S. is at a crossroads! pic.twitter.com/DWgjBdOUZH

DailyNoah.com @DailyNoahNews May 27, 2024

What can you do to fix ….?

I’ll get to that in a moment.

Did you know?

U.S. dollar DOWNGRADED due to “Governance Deterioration

You might have missed something big yesterday amidst the Trump Arraignment news coverage.

We’ve been warning about this for a very long time.

Bo Polny, in particular, has been warning you for nearly two years that the Dollar is about CRASH.

When he said it, people thought he had gone crazy.

Now?

Now it’s not so crazy.

Not at all, especially in light of yesterday’s events.

Credit Rating Agency Fitch has just downgraded the U.S. dollar.

Dollar shaky after US credit rating downgrade https://t.co/du4oaIoooG pic.twitter.com/8Ep3csMcyn

— Reuters (@Reuters), August 2, 2023

If you’re not sure what this all means, I will make it very clear for you.

Have you ever purchased a car or house?

What factors does the bank consider before granting you a loan or credit?

Your credit score.

Just as you have a credit rating, the United States has one too.

Your credit score just dropped.

This chart (based on numbers for 2022) shows how the U.S. government manages its budget compared to a family budget.

It takes the ratios and budget of the U.S. government and translates them into what a family with the Median Income would look like.

The results are amazing:

Would a bank lend to someone with these numbers?

No way!

Not in a thousand years.

Why do other countries still rely on the U.S. dollar?

There is only one simple reason: “the full trust and credit of the U.S. government”.

Investors and other countries believe that the U.S. government will always pay all its bills, somehow.

The U.S. government has never defaulted on its obligations.

What happens when confidence and trust in U.S. government disappears?

The U.S. dollar will crash in an instant.

This is why it’s so important to downgrade.

They cite “deterioration of governance” as one of the primary reasons:

Fitch has downgraded the #US #credit ratings due to deterioration in fiscal and governance. This is a major blow to US reputation and standing around the world. Analysts said that the downgrade could also be part of a gradual decline in the US #dollar. https://t.co/hddzja0wF2 pic.twitter.com/aMcGxHswOV

Global Times (@globaltimesnews), August 2, 2023

We have less faith and confidence in the U.S. government to pay its bills because it is run so badly!

Hello Joe Biden!

Kevin O’Leary confirms that it’s bad: “There’s no sugarcoating this.”

In history, the U.S. credit rating has only ever been cut once.

You can guess the year.

2011.

Joe Biden was vice president when Barack Hussein Obama was busy destructing this country, much like Joe is now.

Reuters has more information:

The dollar rose Wednesday as investors shrugged of Fitch’s downgrade of the U.S. Credit Rating. Data showing a higher-than-expected rise in private payrolls for July also boosted the greenback, as it pointed to labor market strength.

The ADP National Employment Report showed that private payrolls increased by 324,000 jobs in the month of November, which was more than the 189,000 predicted by economists polled and surveyed by Reuters.

The U.S. labour market is slowly slowing down after the Federal Reserve raised interest rates by 525 basis point since March 2022. The economy is still strong, as shown by the Atlanta Fed’s running estimate of the real GDP growth in the third quarter of 3.9%.

Michael Arone, State Street Global Advisors’ chief investment strategist in Boston, said: “The dollar will likely rise more in response to economic data that continues being stronger. Therefore the market believes that the Fed is going to continue raising rates.”

He said that the interest rate differentials between the United States and other countries would continue to grow or be very strong. “The dollar is getting an uptick, along with a little flight to safety.”

The dollar index, which measures the U.S. dollar against six other currencies, has risen 0.57%, reaching a new three-week high. The dollar index is up 3.0% since a 15-month low reached on July 18.

Fitch downgraded the United States on Tuesday from AAA to AA+, a move which drew a furious response from the White House. It also surprised investors. This was despite the resolution of the debt ceiling crisis two months ago.

What happens next?

Banks that fail to pay their bail-ins.

I’m expecting that to happen.

Ever heard of “Bail Ins”?

Let me explain…

SPECIAL ALERT: Here Come Bank “Bail-Ins”!

You’ve probably heard of bank bailouts.

We all learned about them in 2008/09.

And last weekend.

This time, they’re going with something new ….Bank bail-IN.

Why bail out a Bank with money from Congress when you can take the money out of your bank account?

What a novel idea!

This is what I mean:

The 2010 Dodd-Frank Act of the Obama era claims to ‘PROTECT your money’ by allowing banks STEAL IT through a procedure called ‘bank bail-ins.’

It looks like we’ll all be EXPERTS in the coming weeks. pic.twitter.com/LoiTDRZ9Yy

— Epstein’s Sheet. (@meantweeting1) March 11, 2023

This is not a joke.

This is a very real thing.

You can protect yourself by being aware of the dangers ahead.

Kevin, one of the most popular financial YouTubers talks about it.

Patrick Bet David, my man from just a couple of days ago.

Check it out ….

The video of Fed meeting behind closed doors has been leaked. They talk about how they cannot possibly warn the public. We can’t tell people the truth! It will cause mass hysteria.

Stunning.

We will tell you the truth.

Watch this:

HOLY CRAP!!

FDIC Bankers Talk ‘Bail Ins’, Market Collapse & Bank Runs

They are talking about the financial crisis, their lack of trust in our banking system, and how to keep people from panicking.

“I completely agree…you can’t tell the public about this, they would… pic.twitter.com/0dSFYQYWVT

DailyNoah.com @DailyNoahNews March 19, 2023

Click here to learn more

FDIC Bankers Talk ‘Bail Ins’, Market Collapse & Bank Runs

They are talking about the financial crisis, their lack of trust in our banking system, and how to keep people from panicking.

“You don’t want a huge run on the institutions, and, and they’re going to be… () pic.twitter.com/K8yaM8jzta

Angelus caelis March 11, 2023

Why Bank Bail-ins will be the New Bailouts:

https://twitter.com/VersanAljarrah/status/1616842617026658305

It’s coming:

Body Language: FDIC Bank BAIL-INs pic.twitter.com/6IFodaGy5D

— BOMBARDsBL (@BombardsBL), December 30, 2022

ChatGPT knows exactly what they are.

Bank bail-ins help resolve the financial problems of a failing institution by requiring its shareholders and creditors to contribute towards the bank’s recapitalization rather than relying on taxpayer funds. In a bank bail-in, bondholders and depositors who have balances above a certain threshold may have their holdings written off or converted into equity.

This approach is designed to protect taxpayers by not having them bail out a bank in trouble. Instead, the investors and creditors of the bank will be responsible for the losses. Bail-ins have been seen as a means to increase accountability for banks and their investors and to create incentives to operate more prudently.

In response to the global financial crisis that occurred in 2008-2009, bail-ins were implemented in a number of countries. In 2014, the European Union introduced a bail-in scheme that requires failing banks first to use their own resources and funds to resolve their financial difficulties, before seeking public assistance.

Translation of the bold part: Say you had $100,000 in your bank account.

You have $50,000. Or $25,000

They will thank you for your patriotic duty.

Wow, not me!

No way!

I’m going Crypto, Gold & Silver.

It’s just me but I like to keep my money in a place where thieves can’t easily steal it!

Here’s more:

What you need to understand about bank bail-ins Convenient timing considering what’s happening at #Silvergate $SI pic.twitter.com/qrmvfREIDN

Nobody Special (@JG_Nuke), March 2, 2023

The government is right to tell you not to withdraw your money ….they are safe!

The countdown for bank bail-ins has just begun. https://t.co/M4P1co2y9N

— Erik Voorhees (@ErikVoorhees) March 24, 2020

What can YOU do NOW to prepare and take action?

Look, I am not a financial adviser. I can’t tell what you should do.

But me personally?

I have a large portion of my assets in cryptocurrency and another large portion in precious metals.

I keep as little money as possible in banks.

This is what I do to sleep well at night.

Find out more about gold:

Here’s why central banks are buying all the gold they can — and what YOU can do!

Over the past year, central bankers around the world have bought as much gold and silver as they could without alarming anyone. Now we know why.

The “elites” who run the world behind the scenes were aware of the recent bank runs, and the ongoing collapse of the U.S. Banking System. They knew it was coming and knew that the best way to safeguard their assets was by purchasing physical precious metals.

I am happy to share with you something I love.

Precious metals.

I just spoke with Bo Polny about precious metals and I’m bringing to you a solution you can use right away if so inclined…

A conservative precious metals firm with a faith-based approach is helping Americans tap into the growing precious metals market by offering self-directed IRAs backed up by physical precious materials. While this service isn’t unique to Genesis, the company’s adherence to Biblical stewardship makes them uniquely qualified to receive a recommended recommendation from this website.

Genesis, unlike most companies that offer similar services, only deals with physical precious metals. They do not provide “virtual”, “paper” or “paper gold” or silver.

Customers can touch and see the precious metals backing their retirement accounts with Genesis. When it’s time to receive distributions, Genesis customers have the option to cash out some or all their precious metals. They can also choose to have them delivered directly to their home.

Central bankers don’t seem to be slowing down. Even states in the United States, like Tennessee, and nations like China are quietly but quickly buying gold to support their own treasuries. It’s easy to understand why governments would act quickly when the future is so clear.

Our readers will benefit from working with Genesis to explore the physical precious-metals market through self directed IRAs. It is also beneficial to us when our readers choose this America-First company.

Visit genesiswlt.com today or call 866-292-0443.

Don’t wait, there could be more bank failures around the corner.

What has never “failed?”

Gold. Precious metals. Indestructible.

There’s a good reason why they call it “God’s money”.

Watch this video for more information:

“}]]